Commercial Inventory

If you own a small business, you should know about the Section 179 vehicle list for 2024 because it could save you money and help expand your business. The government created this credit to incentivize small business owners to invest in themselves, but what can it do for you?

It can help you purchase the equipment you need now, so you don’t have to wait to generate more cash before making critical business investments. Read on to learn how the Section 179 vehicle list for 2024 can benefit you, who qualifies, and what vehicles you can buy at Milnes Ford.

Section 179 at a Glance for 2024

- 2024 Deduction Limit: $1,220,000

This deduction is available for new and used equipment, as well as off-the-shelf software. To qualify, the equipment must be purchased or financed and put into service between January 1, 2024, and December 31, 2024. - 2024 Spending Cap on Equipment Purchases: $3,050,000

This is the maximum amount that can be spent before the deduction begins to phase out. The cap ensures Section 179 benefits remain a true small business incentive, as businesses spending over $4,270,000 won’t qualify. - Bonus Depreciation: 60% for 2024

Bonus Depreciation applies after the Section 179 Spending Cap is reached. It’s available for both new and used equipment.

For more details on limits and qualifying equipment, contact Milnes Ford today.

What is the Section 179 Deduction?

The Section 179 deduction allows businesses to deduct the full cost of qualifying equipment in the first year, rather than spreading it out over several years. This means you can invest in vehicles or equipment now and save when you file your 2024 taxes.

However, there are limits:

- A $1,220,000 cap on the deduction amount for 2024.

- A $3,050,000 limit on equipment purchases.

- Spending beyond $4,270,000 disqualifies businesses.

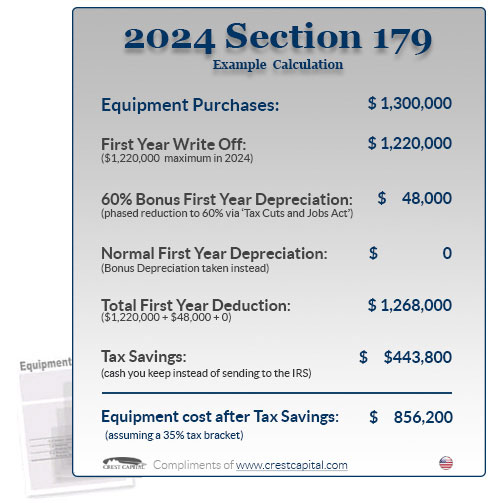

Example of Section 179 in Action:

- Equipment Purchases: $1,300,000

- First-Year Write-Off: $1,220,000

- Bonus Depreciation (60%): $48,000

- Total First-Year Deduction: $1,268,000

- Cash Savings: $443,800

- Cost After Tax: $856,200

Who Qualifies for Section 179?

If your business spends less than $4,270,000 on equipment in 2024, you qualify. Qualifying items include:

- New and used vehicles.

- Off-the-shelf software.

- Equipment placed into service during 2024 and used more than 50% for business purposes.

What Models Qualify?

Milnes Ford offers a variety of vehicles that qualify under Section 179:

- Delivery cargo vans and box trucks.

- Work vehicles designed for business use.

- Specialty vehicles (ambulances, hearses).

- Vans, pickup trucks, and SUVs with a GVWR over 6,000 lbs (partial deduction).

Some qualifying Ford models include:

- Ford truck lineup

- Ford Explorer

- Ford Expedition

Use Section 179 at Milnes Ford

Ready to grow your business? Visit Milnes Ford in Lapeer to explore our selection of Section 179-eligible commercial vehicles. Our team will help you choose the right model and calculate your tax savings.

Let Milnes Ford make your next big business investment easier.